Simplify Freelance Compliance

in 3 Steps

Put an end to chasing — and worrying about — legal docs, tax forms, system access, background checks, workforce classification audits, and more.

Let Fiverr Enterprise handle legal and tax compliance for your freelance talent.

Fiverr Enterprise handles contractor headaches at

Get peace of mind knowing everything’s in order

Set up automated onboarding and off-boarding processes, and monitor in real time with custom reports

01

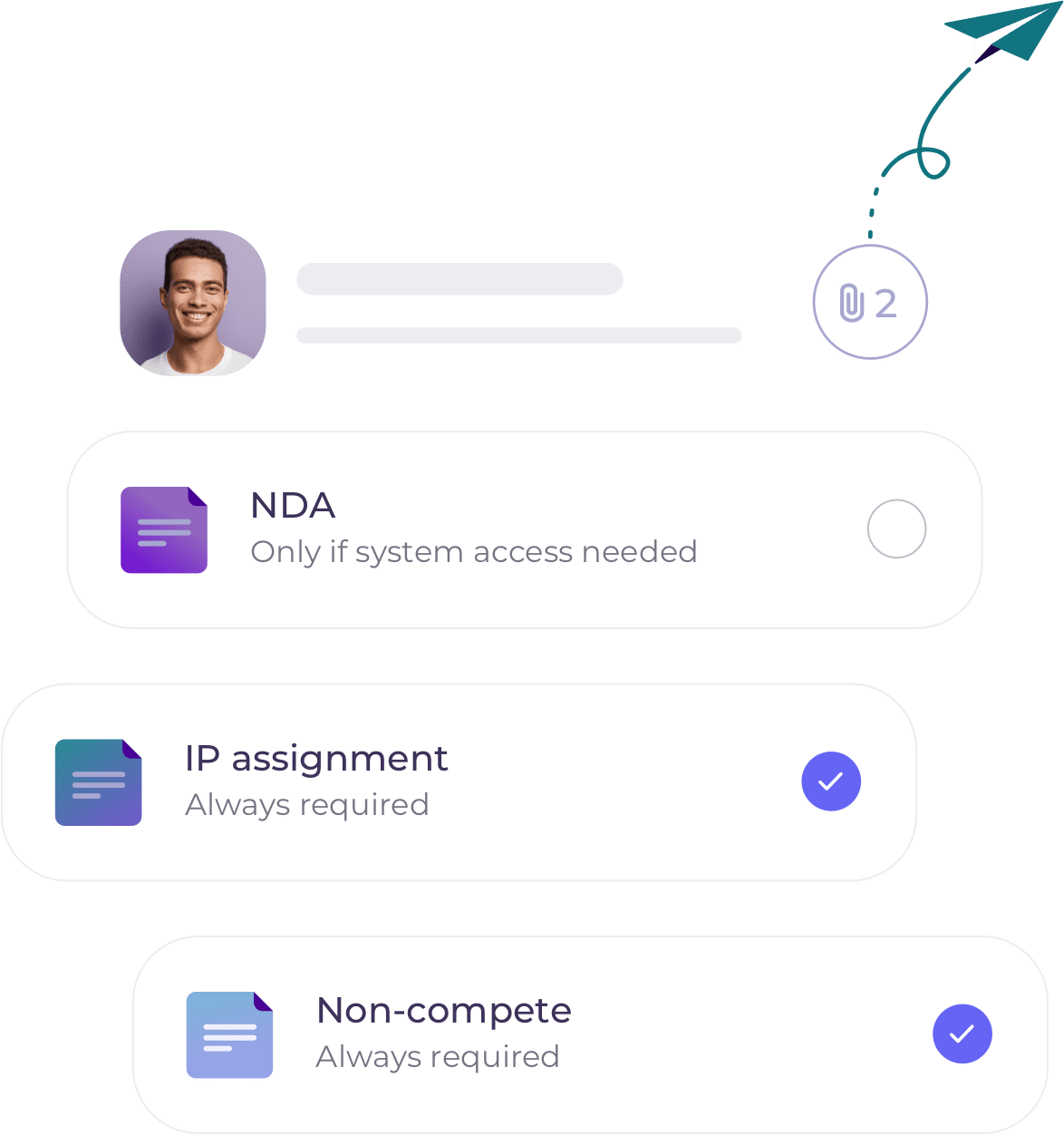

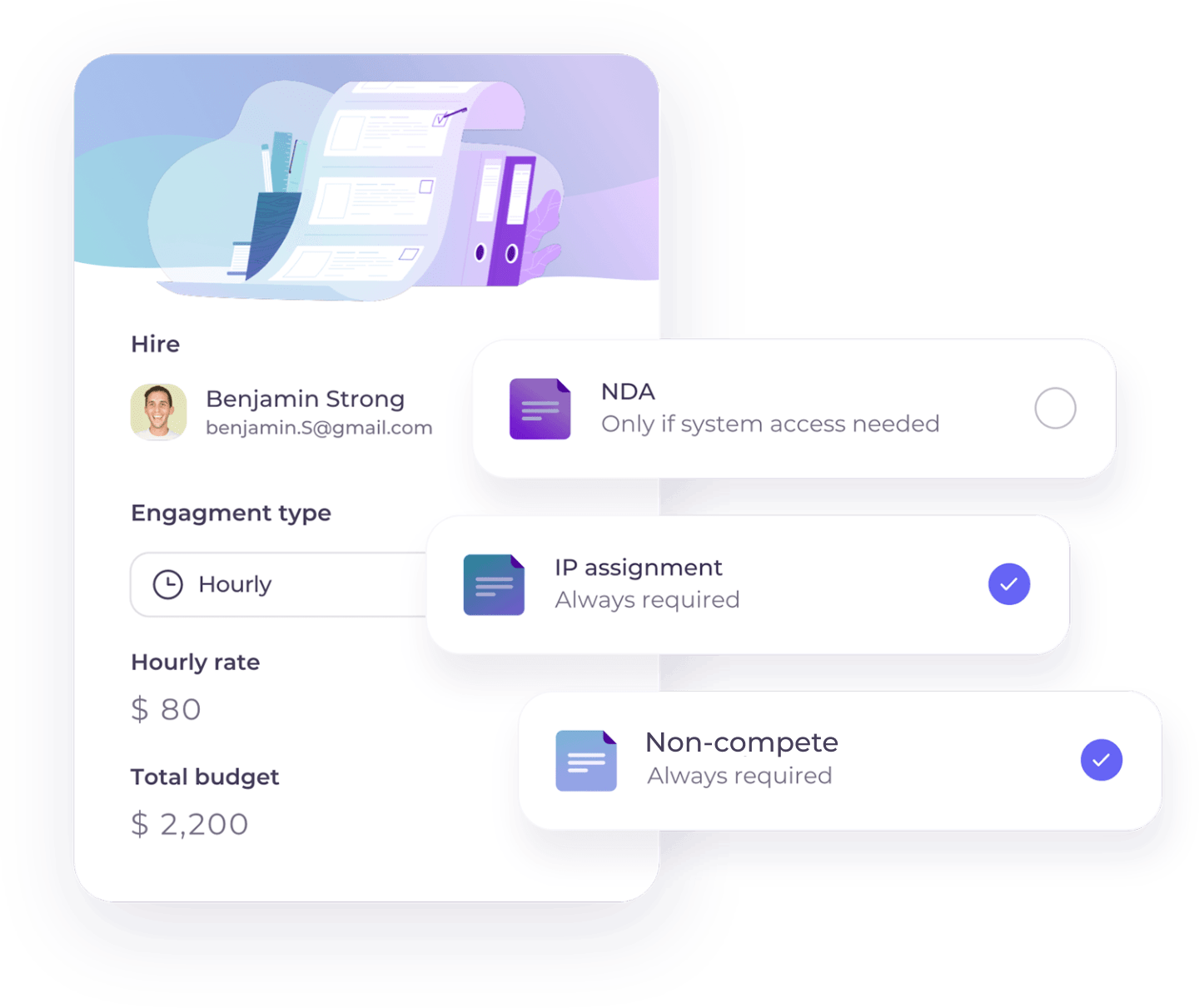

Legal documentation made easy

Let your legal team define what legal documents require your freelancers’ signatures and we’ll send these to your freelancers automatically through DocuSign.

We’ll also validate signatures, store all documents securely, and alert you before they expire, taking care of it all for you, behind the scenes.

02

We take liability over your tax compliance

When working with freelancers, companies must adhere to strict tax requirements. Luckily for you, Fiverr Enterprise takes care of the entire process.

We’ll gather the required tax forms like W-9s and W-8BENs from your freelancers and submit annual tax reports like 1099s or IR-35 to the appropriate tax authority on your behalf.

03

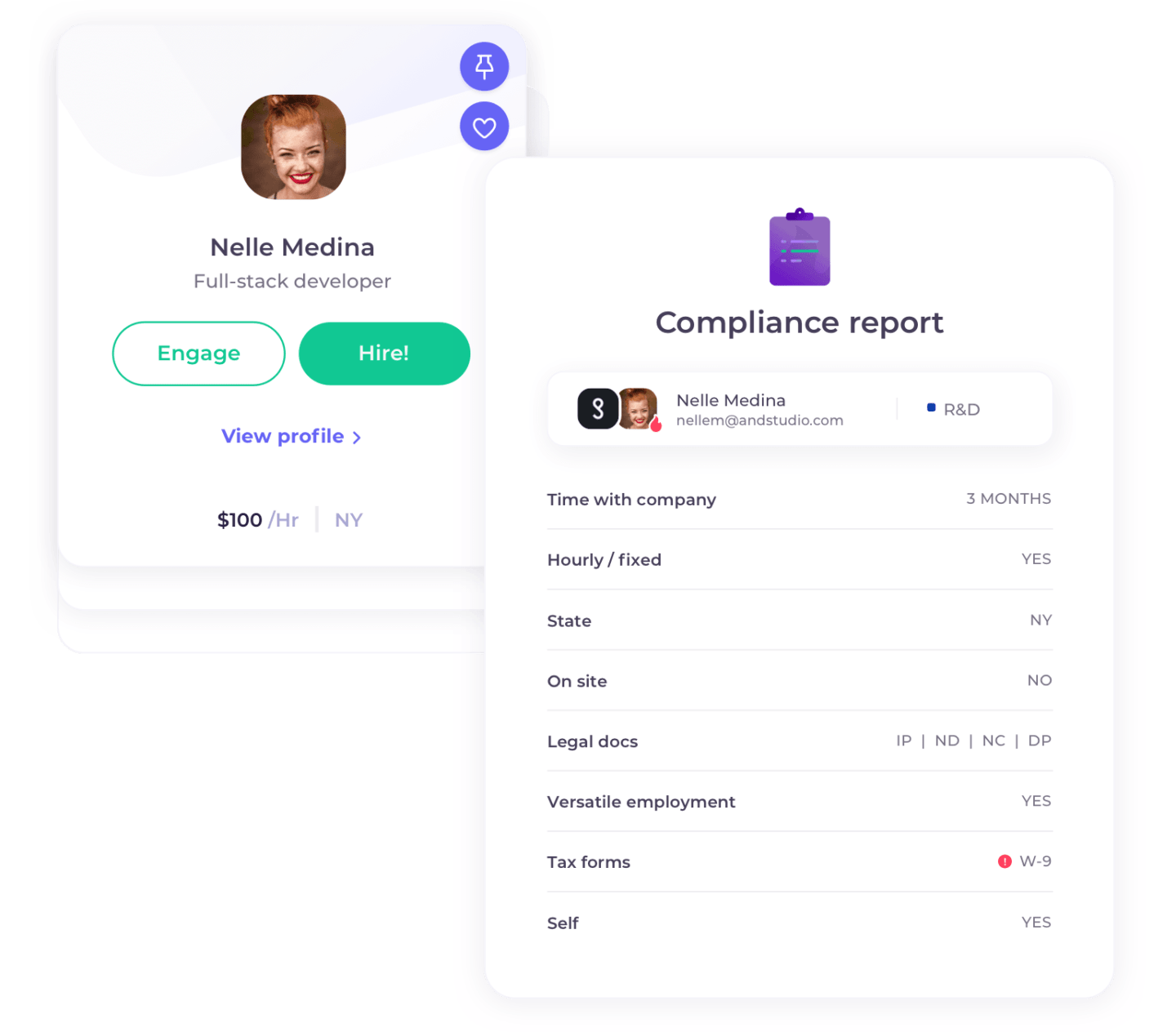

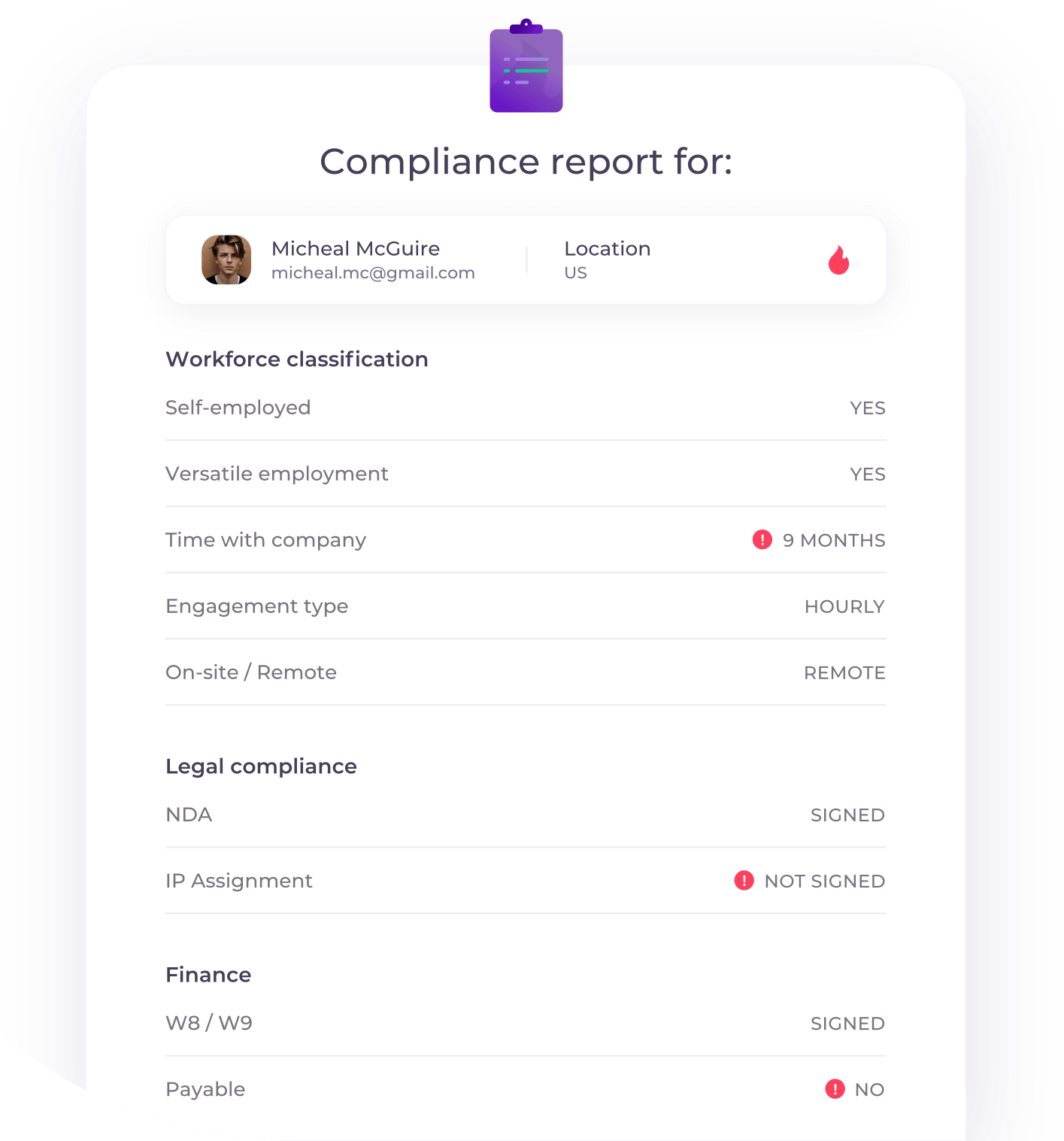

Automated workforce classification audits

Fiverr Enterprise uses AI to analyze your relationship with freelancers based on thousands of previous classification cases.

When a high-risk relationship is identified, an automated audit is run, generating a detailed report that contains actionable suggestions for reducing risk.

How Fiverr Enterprise Works

Fiverr Enterprise’s Freelance Management System (FMS) lets you rely more on freelancers without creating more work for you and your team on the back end. We offer an end-to-end platform that manages everything from hiring to payments.

Benefit from freelance talent the easy way – with Fiverr Enterprise

Hiring

Quickly hire new talent with Fiverr Enterprise’s sourcing service and build an online talent directory for your company

Onboarding

Legal docs, background checks, and managing system access — you can do it all from one platform

Management

Manage project budgets and track planned vs actual spending by departments, teams, or individuals

Payments

Instantly pay invoices to 190 countries in 80 currencies and 7 methods — while you pay 1 invoice a month

Compliance

From tax compliance to employee classification and security, Fiverr Enterprise keeps all your bases covered

What our customers say about us

Fiverr Enterprise was an easy fix for our issues. If we have gaps in talent resources within my team, the usual solution is to add a freelancer. Now it’s so easy to onboard them and get right into the work.

Natalie Cohen

Director of Solution Marketing

I would say the biggest benefit of working with Fiverr Enterprise is gaining full visibility into our budgets and having flexible payment frequency, enabling us to become much more aligned with our business goals. Also have peace of mind when it comes to legal compliance, knowing that we can hire any talent, and Fiverr Enterprise takes care of the rest for us.

Nitzan Brown

Marketing Program Manager

Fiverr Enterprise offers our legal and finance teams a platform that provides full control and visibility, so we can focus on getting projects completed without worrying about onboarding, payment processing, communication, and more.

Dan Ben-Adi

CFO

Since the first meeting with Fiverr Enterprise, there was a “click”. The end-to-end process took us 3 months from the day I released the RFP to the day the system was up and running. In corporate life, this is disruptive.

Shachar Teper

Global Procurement Director